Next: 6 Allocation Policies

Up: 5 Shares vs. Working Sets

Previous: 5.3 Measuring Idle Memory

This section presents quantitative experiments that demonstrate the

effectiveness of memory sampling and idle memory taxation. Memory

sampling is used to estimate the fraction of memory actively used by

each VM. These estimates are then incorporated into the idle memory

tax computations performed by the share-based memory allocation

algorithm.

|

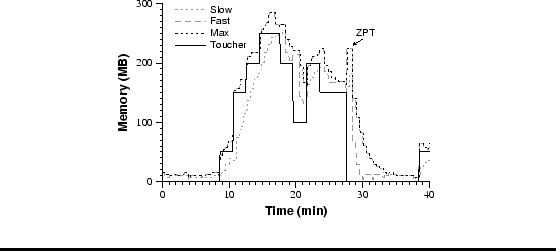

| Figure 6:

Active Memory Sampling.

A Windows VM executes a simple memory toucher

application. The solid black line indicates the amount of memory

repeatedly touched, which is varied over time. The dotted black line

is the sampling-based statistical estimate of overall VM memory usage,

including background Windows activities. The estimate is computed as

the max of fast (gray dashed line) and slow

(gray dotted line) moving averages. The spike labelled

ZPT is due to the Windows ``zero page thread.'' |

Figure 6 presents the results of an experiment

designed to illustrate the memory sampling technique. For this

experiment, ESX Server was running on a dual-processor Dell Precision 420,

configured to execute one VM running Windows 2000 Advanced Server on a

single 800 MHz Pentium III CPU.

A user-level toucher application allocates and repeatedly

accesses a controlled amount of memory that is varied between 50 MB

and 250 MB. An additional 10-20 MB is accessed by standard Windows

background activities. As expected, the statistical estimate of

active memory usage responds quickly as more memory is touched,

tracking the fast moving average, and more slowly as less memory is

touched, tracking the slow moving average.

We were originally surprised by the unexpected spike immediately after

the toucher application terminates, an effect that does not occur when

the same experiment is run under Linux. This is caused by the Windows

``zero page thread'' that runs only when no other threads are

runnable, clearing the contents of pages it moves from the free page

list to the zeroed page list [22].

|

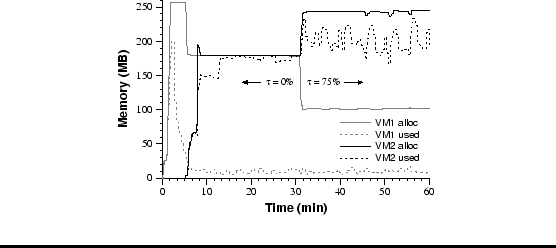

| Figure 7:

Idle Memory Tax.

Two VMs with identical share allocations are each configured

with 256 MB in an overcommitted system. VM1 (gray) runs Windows, and

remains idle after booting. VM2 (black) executes a memory-intensive

Linux workload. For each VM, ESX Server allocations are plotted as solid

lines, and estimated memory usage is indicated by dotted lines. With

an initial tax rate of 0%, the VMs each converge on the same 179 MB

allocation. When the tax rate is increased to 75%, idle memory is

reclaimed from VM1 and reallocated to VM2, boosting its performance

by over 30%. |

Figure 7 presents experimental results that

demonstrate the effectiveness of imposing a tax on idle memory. For

this experiment, ESX Server was running on a Dell Precision 420

multiprocessor with two 800 MHz Pentium III CPUs and 512 MB RAM, of which

approximately 360 MB was available for executing VMs.6

Two VMs with identical share allocations are each configured with

256 MB ``physical'' memory. The first VM that powers on runs Windows

2000 Advanced Server, and remains idle after booting. A few minutes

later, a second VM is started, running a memory-intensive

dbench workload [28] under Red Hat Linux

7.2. The initial tax rate is set to  , resulting in a pure

share-based allocation. Despite the large difference in actual memory

usage, each VM receives the same 179 MB allocation from ESX Server. In the

middle of the experiment, the tax rate is increased to

, resulting in a pure

share-based allocation. Despite the large difference in actual memory

usage, each VM receives the same 179 MB allocation from ESX Server. In the

middle of the experiment, the tax rate is increased to  ,

causing memory to be reclaimed from the idle Windows VM and

reallocated to the active Linux VM running dbench. The

dbench workload benefits significantly from the

additional memory, increasing throughput by over 30% after the tax

rate change.

,

causing memory to be reclaimed from the idle Windows VM and

reallocated to the active Linux VM running dbench. The

dbench workload benefits significantly from the

additional memory, increasing throughput by over 30% after the tax

rate change.

Next: 6 Allocation Policies

Up: 5 Shares vs. Working Sets

Previous: 5.3 Measuring Idle Memory

Carl Waldspurger, OSDI '02